In any economic downturn, there are always opportunities. One such opportunity is the result of higher lending standards, which makes it more difficult for people to purchase homes, as well as a doubling in the number of home foreclosures in the 2nd quarter of this year: higher demand for good quality single family rental homes.

In any economic downturn, there are always opportunities. One such opportunity is the result of higher lending standards, which makes it more difficult for people to purchase homes, as well as a doubling in the number of home foreclosures in the 2nd quarter of this year: higher demand for good quality single family rental homes.

This was my hunch, but it was confirmed this week after receiving a signed lease agreement for a rental property being vacated today. The new lease includes a 5% increase in rent over the previous one and will be the first time I've had no lapse in vacancy upon a tenant's move-out, quite a relief. I've been considering the purchase of another rental property, and after this experience I plan to start researching prospective investment homes.

And watch this to see a disturbing encounter between Will Ferrell and his landlord:

7.31.2008

It's a Landlord's Market

7.09.2007

Is Atlanta real estate a buy?

The NY Times has an article today on Atlanta's increasing rate of foreclosures. What the article fails to highlight is the fact that borrowers in metro Atlanta use interest-only mortgages at a higher rate than the rest of the nation, which is a key contributor to the increased foreclosure rate. Those who took out a 6-month LIBOR +1% interest-only mortgage in June of 2003 when LIBOR was at 1.124% have had their mortgage payments more than triple in the last 4 years.

The NY Times has an article today on Atlanta's increasing rate of foreclosures. What the article fails to highlight is the fact that borrowers in metro Atlanta use interest-only mortgages at a higher rate than the rest of the nation, which is a key contributor to the increased foreclosure rate. Those who took out a 6-month LIBOR +1% interest-only mortgage in June of 2003 when LIBOR was at 1.124% have had their mortgage payments more than triple in the last 4 years.

Buying low and selling high are the keys to profitable investing, but knowing what is a high and/or low is often difficult. My barometer for knowing a good real estate investment opportunity is its ability to generate positive cash flow, but that doesn't apply to people who are in the business of flipping houses.

5.03.2007

The dangers of DIY... stories you won't hear on HGTV

While I've had my share of home improvement accidents... falling off a roof, falling through a ceiling, smashing fingers with a hammer, and severe burns from dripping solder while plumbing... I've never experienced anything that came close to being life-threatening. Others aren't so fortunate, and The New York Times has an article today on the dangers of do it yourself home repair. Warning: this article isn't for the squeamish.

While I've had my share of home improvement accidents... falling off a roof, falling through a ceiling, smashing fingers with a hammer, and severe burns from dripping solder while plumbing... I've never experienced anything that came close to being life-threatening. Others aren't so fortunate, and The New York Times has an article today on the dangers of do it yourself home repair. Warning: this article isn't for the squeamish.

2.14.2007

Profiting on Foreclosures

There was a great article in Saturday's print edition of The Wall Street Journal on making money in foreclosures, and I was glad to see this article make its way to Yahoo's Personal Finance section where you can read it for free!

2.11.2007

Exorcising a possessed toilet

In this toilet I've already had fill valves from Fluidmaster, American Standard, Korky, and today I installed a Peerless/FillPro water saver anti-siphon fill valve. It's much smaller than traditional ones and is only about two inches high inside the tank. I'm hoping this will finally solve the problems and am keeping my fingers crossed.

2.07.2007

My home, my castle: Tankless water heater

Five years ago when my water heater died, I had three options: 1) replace my 40 gallon natural gas-fueled water heater with another one, 2) go tankless, or 3) incur the wrath of my wife. After much research, I opted to install a tankless water heater.

There are several benefits to going with a tankless water heater over a traditional tank water heater. The first benefit is green, both environmental and fiscal. Tankless units use less energy and therefore save you money. Most estimates show that a tankless water heater will use 25 to 45 percent less energy than a tank water heater. While a tankless unit only heats water when a hot water spigot has been opened, a traditional tank water heater is constantly heating water regardless of whether you're using hot water or not. I've personally found the energy savings to be about 20%.

Another benefit to going with a tankless unit is that you never run out of hot water. We have a garden tub in our master bathroom, and our old 40 gallon tank water heater would fill the tub about half way before running out of hot water. With our tankless unit, we never run out of hot water.

And as a real estate investor, I highly recommend replacing tank water heaters with tankless units because they require less maintenance and therefore last longer (often twice as long). It is recommended that homeowners drain a gallon of water once every three months with a standard tank water heater to reduce sediment, whereas tankless units have no tank to drain! And there is little risk in a tankless unit rusting through and flooding a home or basement as can happen with a tank water heater.

One of the few and yet frequent complaints of a tankless water heater is that multiple hot water-using appliances can't be used simultaneously. This, however, isn't a limitation of the tankless water heater itself; rather, this situation is the result of installing a unit too small for one's household use.

I'm guilty of this, but we're making it work for now. Fortunately the situation is pretty easily remedied. The unit I purchased is a Bosch AquaStar 125B-NG and is rated for 3.2 gallons per minute (gpm) at a 55 degree rise (the water flowing out of the unit will be heated 55 degrees above the temperature of it flowing into the unit). This particular model is recommended for 1 major application at a time. That was fine when it was just my wife and I, but having doubled the size of our household, we now take more baths, wash more clothes, and wash more dishes. I ultimately need to either install a second identical unit in parallel or simply swap my Bosch 125B-NG for a Bosch AquaStar 2400E, which is rated for 5.2 gpm at a 55 degree rise and supports 2 major uses at a time.

A very real drawback to tankless units is their cost. A 40-gallon tank water heater will cost around $300 whereas the higher-flowing tankless units will cost around $1,000. In addition to the cost of the appliance, most will need to pay a plumber to install these units. If you're swapping a tank water heater for tankless, expect to pay ~ $500 for installation because of the need to run additional copper water lines (since the tankless mounts to a wall). Installation for a tank water heater used to run ~ $200, though it's now code to install an expansion tank before the water heater which typically pushes the cost to over $400. There is currently a $300 tax credit for gas water heaters having an energy factor (efficiency rating) of .8 or greater, and several Bosch units qualify.

Another reason I opted for the Bosch AquaStar 125B-NG is because I was able to buy a reconditioned unit for $399 with no tax or shipping and with the original manufacturer's warranty from HouseNeeds.com (which still has this same price). And since I installed the unit myself, my labor costs were zero while parts ran me ~ $25 for 1/2" copper elbows, couplings, and pipe.

In hindsight, I look at my move to a tankless water heater as an investment in my home, my castle. And I wouldn't change a thing. I would still go with the smaller unit knowing that I can upgrade later... and knowing I have several rental properties where I can install the smaller unit should I choose to upgrade. If you're a do-it-yourself person or are planning on living in your existing home for a long period of time, I'd definitely go tankless whereas if you're planning on moving anytime soon, I'd save my money to go tankless at the next house.

2.04.2007

Reduce taxes by fighting your property appraisal

Until this past week of winter temperatures, it almost felt like spring was in the air. As in many states, each spring in Georgia is met with the arrival of flowering quince, birds singing, and the dreaded local tax assessor's annual Statement of Appraisal for Residential (and commercial) Property. These statements are used as the basis for calculating property tax for every piece of property, and in my experience, municipalities are becoming more and more aggressive in boosting appraised values to increase revenues from property taxes. Rather than falling into the usual routine of filing this document with your mortgage statements, I'm going to challenge you to appeal this year's appraisal in an effort to reduce your property tax bill.

In years past, fighting your tax appraisal (and therefore your tax bill) required access to tools only available to real estate agents, appraisers, mortgage brokers, and those willing to spend a lot of time digging through real estate filings in the county courthouse. Those days are gone. With tools like Zillow's semi-nationwide Zestimate coverage (thank you for finally providing data on metro Atlanta!!), ShackPrices, HomePriceMaps, and HomeRadar, there is no reason to be ignorant of the value of your home. Information is power, and in this case, information can = money in your pocket.

The first step upon receiving the tax appraisal is to read it thoroughly. Read it again. Each tax appraisal should offer several pieces of information: 1) the appraised value, 2) the process for appealing this appraised value, and 3) the deadline for filing this appeal.

For my county, the process is simple: I need only provide a written statement that I wish to appeal the appraised value, and this written appeal must be postmarked within 21 days of the date of the tax appraisal statement. This appeal is one of the annual rites of spring. The appeal costs me nothing, and the worst case is that my assessed value remains the same; in the best case I get a significant reduction on my property tax bills. The steps and process I'm going to describe are specific to Georgia, so please be mindful that this process and corresponding deadline will vary by state, county, and/or city.

Once the appeal has been filed I wait for the county's response, but while waiting I am also gathering information. As a real estate investors with multiple properties, thousands of dollars are on the line, so I'll use Zillow and the other tools referenced previously to help determine the fair market value of my homes. In addition, I'll compile a list of between 5 and 7 properties that have recently sold to serve as good comparables. If you've recently refinanced your home and paid for an appraisal, you can add this to your quiver if it's to your benefit or at least study the comparables from your paid appraisal to see if they would help your argument.

A couple of months later I receive a letter acknowledging my timely appeal along with an optional worksheet to complete and remit to my local Board of Tax Assessors (hereinafter, "Board"). The key word for this worksheet is "optional". The letter also advises that the Board will review all information in 30 days and respond in writing within two weeks after said review. Included in the worksheet they provide is a summary of the characteristics of my property along with a request to verify the accuracy of these characteristics and to provide additional information to support my appeal. If the characteristics of the home reflect less square footage than the home actually has or there are any details which, if corrected, would actually hurt your argument for reducing the appraised value, I would advise against completing this worksheet.

If you wish to avoid the chance of appearing before the board in person, you may choose to complete the optional worksheet or respond in writing with a detailed explanation of why you believe the tax appraisal is too high and provide supporting evidence, and by all means, include your list of comparables.

I've found success by not completing the worksheet and not responding at all. This works best when the home was recently purchased for much less its tax appraisal. Last year I had a tax appraisal reduced by $50,000 in this way. In other cases I've found success by completing the worksheet and providing a detailed explanation as to why the tax appraisal was too high.

While I've yet to encounter them, the Board of Equalization is the means of last resort if all else fails. They hear all appeals should the Board of Tax Assessors not rule in your favor.

In my years of appealing tax appraisals, the Board has always reduced the appraised value when I follow the procedures and complete items by their respective due dates. I've become much more systematic in my approach to this process as the times I've not had a change in the tax appraisal are always due to either failing to follow procedure or simply not completing paperwork by a deadline.

Please let me know your experience!

1.31.2007

Are you average and is your average mean?

When someone asks if I'm average, I immediately wonder if they're asking about mean, median, or mode? If math isn't your thing or you're intellectually lazy, skip to the bottom data elements. Since you're still reading, I'm going to take you back to junior high or high school math class and use Merriam-Webster to define these terms:

mean = a value that is computed by dividing the sum of a set of terms by the number of terms

median = a value in an ordered set of values below and above which there is an equal number of values or which is the arithmetic mean of the two middle values if there is no one middle number

mode = the most frequent value (or values) of a set of data

For those like me who read these definitions and go "huh?", here are the terms portrayed visually: Practically speaking, let's compute each of these with a dataset of 5 numbers: 29,1,4,1,5.

Practically speaking, let's compute each of these with a dataset of 5 numbers: 29,1,4,1,5.

Mean

29+1+4+1+5 = 40; 40÷5 = 8

Median

The numbers in value order --> 1 1 4 5 26 ... and the middle number (or the median) = 4

Mode

With the data set 29,1,4,1,5... the most frequently occurring or repetitive number = 1

When dealing with statistics about finances and income, the press is often sloppy in their use of the term "average". While most do not use mode, many identify both median and mean as average, which is too imprecise. If you add a few zeros along with a comma or two, the numbers in my dataset could be housing prices or household incomes, and not knowing whether a number is median or mean can have a big impact on how the numbers are interpreted . Because outliers, such as the number 29 in my dataset above, can skew the calculation of mean, many cost and income-based financial statistics are computed as median so that half of all such costs (or incomes, housing prices, etc.) fall above this value and half fall below.

While statistics may not lie, liars use statistics, so know the difference between mean, median, and mode. And with that lesson, here are a few facts about average in the U.S. of A.:

Median home value = $167,500

Mean travel time to work = 25.1 (minutes)

Median age = 36.4 years

Average* household size = 2.6

Average* family size = 3.18

* - assumed to be mean, but it's not clear

ALL

Median household income = $46,242

Mean household income = $62,556

Families

Median household income = $55,832

Mean household income = $72,585

Nonfamily household

Median household income = $28,050

Mean household income = $39,741

And if you're looking for a real-life example of an outlier, Bill Gates has more wealth than the bottom 45% of American households combined.

Note: All stats are from the economic profile of the 2005 American Community Survey from the U.S. Census Bureau unless otherwise noted. This survey breaks the data down further into these other profiles: demographic, social, and housing.

[update added March 13, 2007] For a fantastic essay described as "the wisest, most humane thing ever written about cancer and statistics" read The Median Isn't the Message by Stephen Jay Gould.

1.23.2007

Ben Stein is wrong about Real Estate Investing

Ben Stein is an incredibly smart guy. You might know him by any one of these titles: actor (he was the boring economics teacher in Ferris Bueller's Day Off), host of Comedy Central's show "Win Ben Stein's Money", author of 16 books, speech writer for presidents Richard Nixon and Gerald Ford, or university law professor. Ben also writes a financial column every other Monday at Yahoo! Finance, and it's usually full of sage advice. This week's article "A Home Truth about Real Estate Investing" was an exception.

Ben also writes a financial column every other Monday at Yahoo! Finance, and it's usually full of sage advice. This week's article "A Home Truth about Real Estate Investing" was an exception.

As a part time real estate investor, the title of this week's column caught my attention. I was teased by the short description which reads, "Owning real estate brings great joy and even makes a good investment. For long-term gains, though, stocks are better." I was dumbfounded. I've owned stocks & mutual funds for 15 years, but the returns on my investments in several single-family rental properties have beaten my returns in the stock market, hands down. Could I be a smarter real estate investor than Ben Stein? This fleeting thought was unfathomable, so I read on.

It was only after completely reading his column that I realized the source of my disconnect: I can't recall ever hearing an economist, particularly one who is a "commentator on finance", consider the purchase of one's own domicile to be real estate investing. Mr. Stein's article does a disservice to the practice of real estate investing, which most consider to be the act of acquiring real estate for purposes of generating rental income or profit from resale after capital appreciation (my definition). My own real estate investing has delivered consistent positive cash returns each year, not to mention the huge tax benefit in being able to offset rental income with that most wonderful non-cash expense, depreciation. Once rented, without exception, each property has been cash flow positive while consistently showing a tax loss because of depreciation and section 179 expenses.

Considering his argument for a moment, however, I would challenge Mr. Stein to look at the alternative to purchasing a house/condo. I see a flaw in his logic because buying stocks on broad indexes isn't the alternative to purchasing a house/condo to live in; renting a house/condo is the alternative! I'm fortunate that I don't live in an expensive real estate market (metro Atlanta), but even still, I can't see how, with tax considerations, buying a house is less "profitable" than renting.

And on the topic of real estate, today I learned that Zillow has just begun providing Zestimates for many homes in metro Atlanta!

9.10.2006

Why I think my west coast friends are crazy

Forbes has a new article out addressing the shift in real estate from a seller's market to a buyer's market. I didn't find the article that revealing, but it did point me to empirical proof that Atlanta offers terrific real estate value relative to the rest of the country.

Forbes has a new article out addressing the shift in real estate from a seller's market to a buyer's market. I didn't find the article that revealing, but it did point me to empirical proof that Atlanta offers terrific real estate value relative to the rest of the country.

With the nation sitting at a median housing price of $225,000, metro Atlanta has a median price of just $172,722 which is 23% less than the national average.

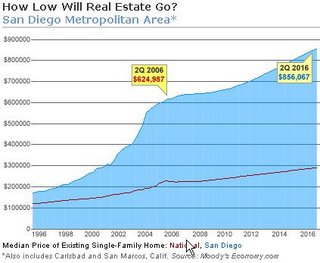

The title of today's post not only applies to many cities on the west coast, but Boston, Washington D.C., and Miami as well. For my friends out west, the graph of San Diego reflects the norm in most west coast markets where the median price of a single family home is two to three times the national average, which is incomprehensible to me. While I think the views can be spectacular, perhaps I'm myopic, but I don't see the appeal of paying a 100-200% premium for the privilege of living there.

For my friends out west, the graph of San Diego reflects the norm in most west coast markets where the median price of a single family home is two to three times the national average, which is incomprehensible to me. While I think the views can be spectacular, perhaps I'm myopic, but I don't see the appeal of paying a 100-200% premium for the privilege of living there.

9.02.2006

Two Milestones

Starting something and "sticking with it" isn't a trait people with ADHD are known for so I'm both surprised and pleased that I've now been blogging for over a year, the first milestone (and my first blog posting remains one of the most frequently-viewed pages). The second milestone is one to really celebrate. The punchlist from my project house only has two items left: a second coat of paint on the garage doors & replacing two rails on the deck, which will take about an hour to complete. As a result, my family finally gets me back on the weekends. Today we had breakfast together and then went to the park to play T-ball and swing. In celebration of this momentous occasion, my wife and daughters presented me with two iTunes-created CDs, the first entitled, "Thank God It's Over".

The second milestone is one to really celebrate. The punchlist from my project house only has two items left: a second coat of paint on the garage doors & replacing two rails on the deck, which will take about an hour to complete. As a result, my family finally gets me back on the weekends. Today we had breakfast together and then went to the park to play T-ball and swing. In celebration of this momentous occasion, my wife and daughters presented me with two iTunes-created CDs, the first entitled, "Thank God It's Over".

Here is the playlist:

- Burning Down the House / Talking Heads

- Paint It Black /U2

- Crumblin' Down / John Cougar Mellencamp

- Sledgehammer / Peter Gabriel

- You Wreck Me / Tom Petty & The Heartbreakers

- Finest Worksong / R.E.M.

- Hammer and a Nail / Indigo Girls

- Digging in the Dirt / Peter Gabriel

- Building a Mystery / Sarah McLachlan

- Fix You / Coldplay

- Wonderwall / Oasis

- Over My Head / The Fray

- My Own Two Hands / Ben Harper & Jack Johnson

- Who Needs Sleep? / Barenaked Ladies

- Room Without a View / The Smithereens

- In Your Room / The Bangles

8.06.2006

60mph winds + penny-sized hail = trouble

It's blurry because the photo is from my camera phone, but I had a tree fall and hit the roof of one of my rental homes. While the tenant has started moving his things into the house, fortunately he isn't living there yet.

It's blurry because the photo is from my camera phone, but I had a tree fall and hit the roof of one of my rental homes. While the tenant has started moving his things into the house, fortunately he isn't living there yet.

The tree knocked down the new gutter & downspout I just installed, but because I went with PVC gutters rather than aluminum, I was able to get it re-hung pretty quickly.

7.30.2006

Mind on the gutters

I closed on my first rental house on September 7, 2001. It took nearly a year, but my wife and I did a complete remodel to the property ourselves, including a tear-down of an addition to the house that accounted for nearly 1/3 of the home's square footage. That addition needed to go--the roof leaked and termites and carpenter ants were feasting on its walls.

I closed on my first rental house on September 7, 2001. It took nearly a year, but my wife and I did a complete remodel to the property ourselves, including a tear-down of an addition to the house that accounted for nearly 1/3 of the home's square footage. That addition needed to go--the roof leaked and termites and carpenter ants were feasting on its walls.

Now almost 5 years later, tomorrow I start the last remaining punchlist item on this remodel: gutters.

7.07.2006

Realtor partner for Cobb County

I made some negative comments earlier this year about real estate agents, and I regret not addressing the exceptions.

I made some negative comments earlier this year about real estate agents, and I regret not addressing the exceptions.

Over the last several years I've interviewed and spoken with numerous real estate agents hoping to find one to ally myself with for real estate investing. Last year I finally found my partner for residential real estate transactions in East Cobb: Kathy Drewien's North Atlanta Realty Group. I worked with both Kathy and Vivian Lacy when I purchased my fixer-upper last year.

I believe that good service is rare, and I don't endorse someone's product or service lightly. Kathy claims to offer trusted, personal, professional service, and she is true to her word. I've recommended her services through word-of-mouth, but like the Dyson vacuum and Briggs & Riley luggage, I decided I needed to give the North Atlanta Realty Group mention in my blog.

And those looking for representation farther north (the I-575 corridor of Cherokee, Pickens, and Gilmer counties) would be well-served by Brad Nix from Maxsell Real Estate. Brad also keeps an active blog at Atlanta 575 Real Estate.

7.03.2006

Renters wanted

Fortunately it's not the perfect storm where none of my rental properties have tenants, but it still hurts to have two homes with vacancies.

Fortunately it's not the perfect storm where none of my rental properties have tenants, but it still hurts to have two homes with vacancies.

Yesterday I had an open house, and despite having several individuals commit to touring the place, no one showed up. Later, though, I scheduled an appointment with someone to tour another property I recently finished. About an hour after scheduling the appointment, another individual called wanting to see that same property, so I scheduled her for the same time.

I've found that scheduling two or more prospective tenants at the same time creates a sense of urgency to submit an application along with the $40 fee, and today was no exception. Not only did I get the application and fee, but she also put down the deposit (same as first month's rent) as she expected her credit report to be spotless. It's too late to pull her credit report today, but I will first thing on Wednesday, and I'm keeping my fingers crossed.

6.15.2006

Maybe by 3:00am

My head hit the pillow when I began hearing a "ping... ping... ping..." sound. It sounded like a bb pellet hitting a metal shed, but it was too rhythmic to be that. Then it hit me--s#!t, water is leaking somewhere.

My head hit the pillow when I began hearing a "ping... ping... ping..." sound. It sounded like a bb pellet hitting a metal shed, but it was too rhythmic to be that. Then it hit me--s#!t, water is leaking somewhere.

Sure enough, it was the usual suspect. I have a toilet that is possessed in my upstairs guest bathroom, and after replacing every f*#^ing gasket and part on the damned toilet, it still wants to piss me off. This time it's really done a number and leaked down to the ceiling on the first floor. The sound I heard was water dripping off of a light fixture (the light in the right of this pic) into the sink in the wet bar.

Add this to the honey-do list. And Mom & Dad, I promise this will be fixed permanently by the time you visit over the 4th of July holiday.

5.31.2006

Almost finished

The standing joke is that for the last several months, whenever someone asked how my project house was coming along, my response has been, "It's almost finished."

The standing joke is that for the last several months, whenever someone asked how my project house was coming along, my response has been, "It's almost finished."

Well now it really must be almost finished since the things left on my punch list are things I really loathe doing like working with insulation. It was 94 degrees in Atlanta yesterday--10 degrees hotter than in Dallas/Fort Worth, so why I didn't do this when temperatures were conducive to wearing long sleeves, jeans, gloves, and a respirator are beyond me, but the job is now finished and the basement walls are insulated. Next step: hang the drywall.

5.10.2006

Rain, rain, go away!

I'm still holding out hope these bands will pass as I wanted to install facia in several places after work. I've painted the Harditrim planks, cut them to size, and even have someone coming to help me (because of their weight).

I'm still holding out hope these bands will pass as I wanted to install facia in several places after work. I've painted the Harditrim planks, cut them to size, and even have someone coming to help me (because of their weight).

The Weather Channel's Desktop Weather application gives an hourly forecast for the next 24 hours, and it's been incredibly accurate throughout this project. Unfortunately it's telling me I'll see thunderstorms until 3:00am.

5.01.2006

Almost done

I spent the entire weekend praying for no rain while doing prep work, and then painting the project house. If the president is a decider, then I'm a doer. I don't like prep work; I enjoy the feeling of accomplishment when I can see real change.

I spent the entire weekend praying for no rain while doing prep work, and then painting the project house. If the president is a decider, then I'm a doer. I don't like prep work; I enjoy the feeling of accomplishment when I can see real change.

For the task of painting this house, I have the proper tools--a pressure washer and an airless paint sprayer. Even with the right tools, though, I had several challenges this weekend. The first challenge was what to do with fascia that was being destroyed by carpenter bees. They're really bad this year, at least at this house. I decided to take the gutters down and remove the damaged fascia rather than plug the holes to repair the damage. It took trips to two Home Depots, but I finally located Harditrim fiber cement planks that are designed for use as fascia. I'm really happy with the James Hardie siding I installed, and carpenter bees won't stand a chance against fiber cement.

As I removed the fascia, I noticed that some of the gutters had rust spots on the bottom, and upon further inspection, I realized that these were galvonized metal gutters rather than aluminum. This sucks--galvonized metal eventually rusts, which is why it's not often used today as material for gutters. An inspection of all of the gutters revealed several that need to be replaced because they've actually rusted through. Replacing the fascia and gutters will be a project for another weekend, however, as the cement planks are heavy and gutters are simply a two-person job. As I was painting, another challenge was that the hose from my airless paint sprayer to my spray gun was about 4 feet too short to reach the top of the house. I bought a 30" extension for the tip of my spray gun, but even that wasn't long enough. My first solution was to elevate the sprayer and paint by making my own scaffolding between two ladders as you can see in the picture above. After a paint accident taking the sprayer and 5 gallon bucket of paint down, though, I got wise when it came time to paint the other side of the house. There I moved the sprayer inside the house and ran the hose out the window.

As I was painting, another challenge was that the hose from my airless paint sprayer to my spray gun was about 4 feet too short to reach the top of the house. I bought a 30" extension for the tip of my spray gun, but even that wasn't long enough. My first solution was to elevate the sprayer and paint by making my own scaffolding between two ladders as you can see in the picture above. After a paint accident taking the sprayer and 5 gallon bucket of paint down, though, I got wise when it came time to paint the other side of the house. There I moved the sprayer inside the house and ran the hose out the window. It did rain a couple of times on Sunday, but never for more than 15 minutes. I'm bruised (mostly from catching an extension ladder in the chest), battered, sore, and I feel like I'm coming down with a cold. But I was able to get the house painted... well, mostly. In my state of exhaustion, I neglected to notice I hadn't painted the upper section as you can see in the photo. I'll get to that soon along with painting the trim.

It did rain a couple of times on Sunday, but never for more than 15 minutes. I'm bruised (mostly from catching an extension ladder in the chest), battered, sore, and I feel like I'm coming down with a cold. But I was able to get the house painted... well, mostly. In my state of exhaustion, I neglected to notice I hadn't painted the upper section as you can see in the photo. I'll get to that soon along with painting the trim.

And my belief that this was a wise investment was partially validated today. The neighborhood where this home is located feeds into Walton High School, which was the 2nd Georgia school listed in Newsweek's Top 1,000 U.S. High Schools, coming in at #181.

4.28.2006

I hate plumbing

No, this isn't a kind of hate like that felt towards collards or my Mom's meatloaf, this is a raging hatred like how I feel towards... well, nothing really comes to mind. But suffice it to say that the hatred I feel towards plumbing is the same kind of hatred as God feels towards sin.

No, this isn't a kind of hate like that felt towards collards or my Mom's meatloaf, this is a raging hatred like how I feel towards... well, nothing really comes to mind. But suffice it to say that the hatred I feel towards plumbing is the same kind of hatred as God feels towards sin.

Yes, the posting time on this blog is correct. It's 3:00am, and I've spent the last 6 hours installing a water heater at a tenant's house. Why did it take 6 hours? Because it's plumbing, and because Home Depot sucks--I had to visit three different stores to find the right plumbing parts I needed. And while I'm getting better at eliminating leaks in my soldering, I had leaks where I connected copper to PVC. It's probably not code, but the laundry area in this particular house has PVC supply and feed lines.

While I brought all of the plumbing tools I needed, I forgot to bring my gloves, and thus the black hands. And why do I have foil HVAC tape wrapped around the tip of my left index finger? It's serving as a bandaid. I didn't have a first aid kit in my truck, and I needed to stop the bleeding. And yes, it is a pain in the butt to type with a piece of foil HVAC tape wrapped around the tip of your finger.

I'd really like to find a good, reliable plumber in East Cobb so I can keep my rich inventory of cuss words buried and unspoken. Anyone know of a good plumber in Marietta, GA?